I would never (as a CPA) recommend that you stop paying taxes as a form of protest.

Federal income taxes are the U.S. government’s largest source of revenue. So far in 2025, income taxes brought in $1.82 trillion. That’s 52% of total federal revenues! In comparison, corporate income taxes were just three hundred billion dollars ($0.30 trillion), 9% of total revenues.

And I understand the feeling of wanting to stop paying in because you don’t like the way the government is spending your money. Because you don’t like seeing people grabbed off the streets or from their jobs or from court proceedings. Because mass “deportations” and “detention camps” make you sick. Because you can’t tolerate family separations and state-sponsored prejudice. Because you don’t want to fund tax cuts for billionaires.

Still, I cannot recommend that you stop having federal income taxes taken from your paycheck.

But… I would absolutely recommend that you don’t overpay your taxes.

Stop Giving the Government Interest-Free Loans

Most people do. That’s why they end up getting refunds. Because they paid too much, literally giving the government interest-free loans. So the government gets to use your money all year instead of you having it to pay your bills. And they give it back to you at tax time, hopefully without much delay.

Though with major cuts to IRS funding, who knows when – if? – your refund will get processed and paid out next year.

And with inflation and tariffs and unthinkably huge cuts to essential services like Medicaid and SNAP, most of us need that extra money in our own hands more than ever.

There’s a very simple way to make that happen. All you have to do is reduce your withholding tax with a new Form W-4.

Can I Lower My Withholding Taxes?

You can change your withholding taxes at any time. You can lower them. You can increase them.

You can even reduce your federal withholding and leave your state taxes untouched.

All it takes is submitting a new Form W-4 (more on that in a moment) to your employer.

If you have online access to your payroll account, you can probably log in and do it online. Otherwise, you’ll need to fill out a form to submit. You can check with your employer, usually the HR department, to find out if they need a hard copy form.

5 Reasons to Change Your Withholding Taxes

To repeat, I’d never recommend someone lower their withholding as a form of protest. That said, there are plenty of reasons it makes sense to adjust the amount of taxes being taken out of your paycheck.

- You’ve had a change in circumstances. A new baby, marriage, divorce, starting student loan payments, second job, third job, losing a job. All of these life events affect how much tax you’ll owe. Any time there’s a major change like that, take a look at your withholding. Because you may be handing over too much every paycheck.

- You got a big refund last year. If you got a refund of more than $200, your withholding is too high. I recommend that people aim for zero – no refund, no payment – when they file their taxes. So if you end up with a huge refund, you’re handing your money over to the government for no reason. Take it back.

- You can’t make ends meet. Maybe you had a financial crisis, like losing a job or suffering a major injury. You need every dollar you can scrape up to make ends meet. Reducing your tax withholding, even just temporarily, puts more money in your hands right now.

- You had income with no taxes taken out. Maybe you sold off some investments, started a side gig with 1099 income, or pulled money out of a retirement account. Even though that money didn’t have taxes taken out, you still owe taxes on it. If you don’t want a huge tax bill when you file, you can change your withholding now to take out a little more each pay period. You’ll have a little less cash now, but you won’t have to come up with as much when your tax bill comes due.

- You qualify for tax deductions and credits. A lot of people don’t realize they qualify for tax deductions and credits, so they don’t take them. And they end up paying more taxes than they really owe. Deductions reduce your taxable income, so they also lower your taxes. Credits act like tax coupons, they pay part of your taxes for you.

Learn more about tax deductions here.

Find out if you’re eligible for tax credits here.

Again, let me be clear. I can’t recommend reducing your withholding tax as a form of protest. But it’s important to know all the reasons it makes sense to change your withholding.

How to Reduce Your Withholding Taxes

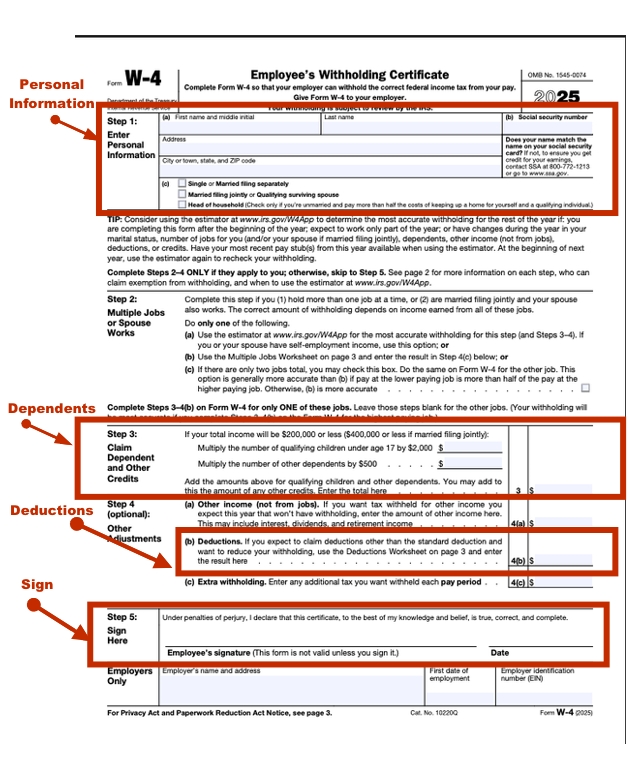

Filling out Form W-4 is how you lower your withholding taxes. You probably filled one out when you first got your job and never thought about it again. But now is a good time to take a look and make some changes.

The form looks complicated. It is. But we’re going to walk through it together. First thing, look at your current Form W-4 to see what it says. That’s the easiest starting point for most people.

There are five sections on Form W-4. The first is just your personal information, and you’ll need to complete that any time you fill out a new form. Same for part 5, signing the form.

If you’re looking to come as close to possible to zero (not owing and not getting a refund), you’ll need to do some calculating. You can use the Tax Withholding Estimator on the IRS website. You can also use that tool to see the effect of any change you make on your W-4.

But if you just want to reduce your current withholding, all you have to do is either:

- Increase the number of dependents listed in Step 3 or

- Fill in Step 4(b): Deductions with the amount you want to keep in your paycheck. This amount can’t be more than the dollar amount currently being withheld from your pay.

What Happens If I Underpay Taxes?

Decreasing your income tax withholding can lead to underpayment of your taxes. And that can lead to potential consequences, including:

- A very big amount owed when you file your taxes.

- IRS interest and penalties on the underpayment amount.

And if you don’t pay your bill and don’t respond to IRS collection attempts, higher-level consequences include:

- liens on your assets

- wage garnishment

- asset seizures

- passport seizure

So you need to be aware that not paying taxes can potentially lead to significant financial consequences. Even possible jail time if the government determines you’ve committed tax evasion or tax fraud, but that’s only in extreme cases.

Bottom Line: If you want to change your withholding taxes, for any reason, you’ll need to complete a new Form W-4 and submit it to your employer.

Yes, The Amount of Your Withholding Tax Does Matter for a Lot of Reasons

I know we’re going through radically difficult times right now. And any way you want to protest is totally valid.

Making sure that you’re not giving the government a huge interest-free loan by paying too much in taxes is not only your legal right, it is a big part of what this country was founded on. So it’s practically your patriotic duty to reduce your withholding taxes if you are paying too much.

You can use the IRS tool to see how much extra you’re paying in.

If your circumstances haven’t changed, you can take last year’s refund, multiply it by 90%, and then divide it by how many pay periods are left in the year. That gives you a good ballpark for how much to reduce your per-paycheck withholding by.

Remember, if you realize later in the year that you may not have withheld enough, you can always adjust it again.

If you’re concerned about “getting this wrong” and screwing something up when you fill out your new W-4, please reach out to me. I offer mid-year tax planning help, and that involves helping a lot of people redo their W-4s.

Click on the button below to contact me and I’ll get back to you ASAP.