No one wants to think about what will happen to them if they’re permanently injured or suddenly unable to work for any reason. It’s scary and not something most people prepare for.

Disability is difficult, if not impossible, to plan for accurately. You don’t know if or when it’s going to happen and what sort of financial assistance you’ll need. And the fact is, it’s more common than you think.

But consider this: a twenty-year-old worker has a one-in-four chance of becoming disabled before they reach retirement age.

That’s what Social Security Disability Benefits are about – helping people who cannot work to support themselves.

The Social Security Administration’s (SSA’s) statistics show that in 2022 the agency received 1.8 million applications for disability benefits Out of those the SSA awarded benefits in only about 543,000 cases. Currently about 7.4 million workers receive disability payments.

I know everyone hates thinking about this – I know I do. But between car accidents, on the job injuries, cancer, long Covid, and other debilitating illnesses, a lot of people become too disabled to manage a job. And while Social Security disability benefits do help a lot of people, it’s not guaranteed that you’ll get them.

But it’s worth applying if you qualify. Because when you can’t work, you need help making ends meet.

Social Security Disability Insurance – What Is It and How Does It Work?

The government pays two kinds of disability benefits: Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI). We’re only talking about SSDI for adults (it works differently for kids) in this blog post.

You can find out more about SSDI, SSI, benefits for children with disabilities, and pretty much everything having to do with Social Security in my book, Social Security 101 2nd Edition.

The SSA explains its disabilities program in this way:

Social Security pays benefits to people who can’t work because they have a medical condition that’s expected to last at least one year or result in death. While some programs give money to people with partial disability or short-term disability, Social Security does not.

Finding out whether you qualify for SSDI is the first step. That involves both an assessment of your ability to work (by the SSA) and earnings tests.

Earnings Tests

To determine whether you’re eligible for Social Security disability benefits, you must consider two earnings tests:

- A duration of work test

- A recent work test

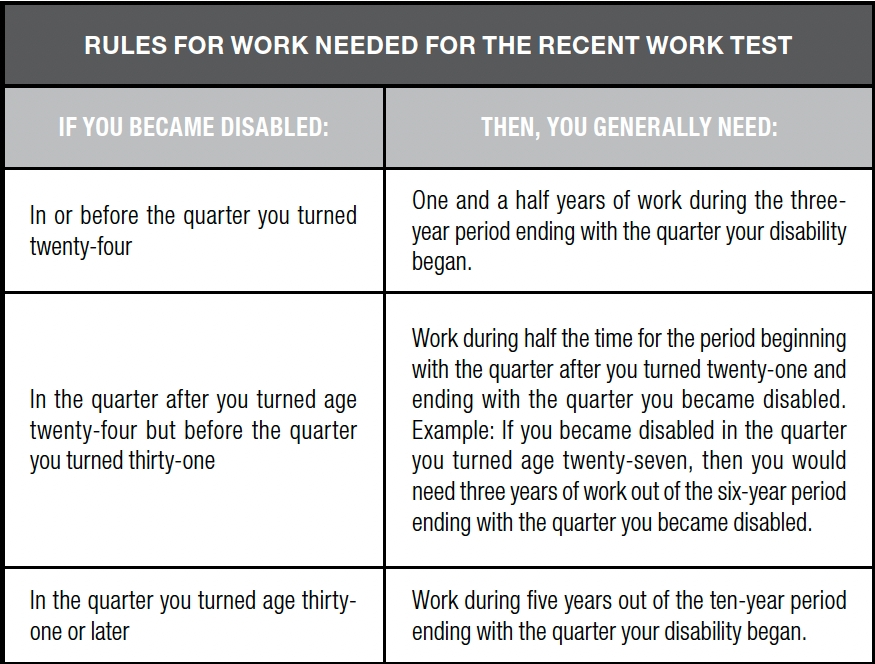

For the recent work test, the SSA offers the following “easy to use” rules table:

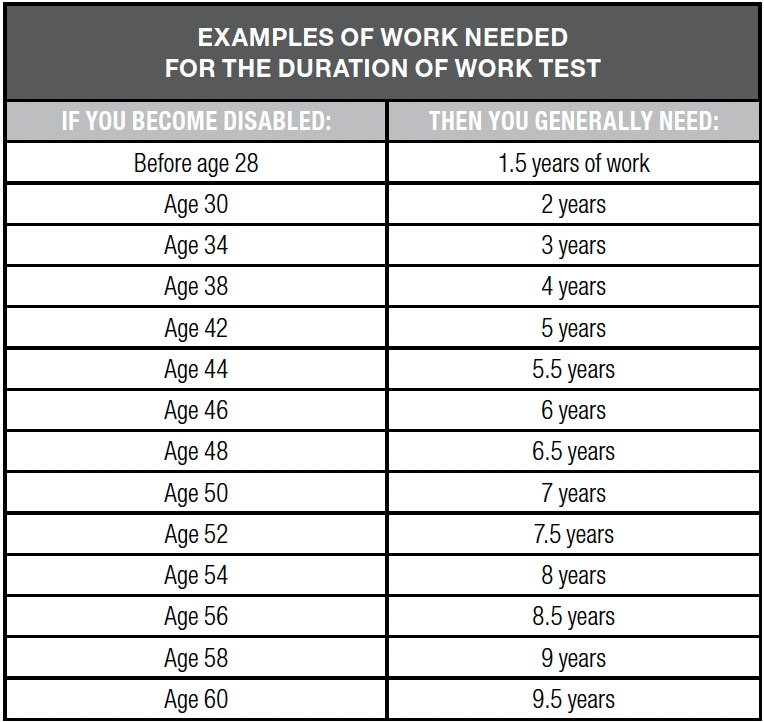

The SSA also provides a table to determine where you stand on the work test:

Applying for Disability Benefits

You can apply for disability benefits in three ways: by phone at 1-800-772-1213, in person at an office, or online.

SSDI comes with an automatic five-month waiting period (unless you have been diagnosed with ALS), meaning benefits will start no sooner than during your sixth full month of being disabled. And that’s if you’re lucky.

Application processing time for SSDI can take an average of three to five months – sometimes even longer – so it’s important to start the application process right away once you know your disability qualifies.

To apply, you’ll need a lot of information and documentation, including:

- Social Security number

- Birth certificate

- Name, Social Security number, and birth date of your current or former spouse, marriage date and location, and divorce or death date if applicable

- Names, addresses, and phone numbers of the medical personnel who took care of you and the dates on which you received care

- Names and dosages of prescription medicine you take and who prescribed them

- Medical records related to the treatment you’re receiving from doctors, therapists, hospitals, and clinics

- Laboratory and test results and the name of the practitioner who ordered them

- The amount of money you earned this year and last year

- Proof of where you worked and what kind of work you did

- A recent W-2 (if self-employed, your most recent tax return)

If this sounds like a lot of stuff, it is. Sadly, this being the government after all, you’ll spend quite a lot of time filling out forms. Keep going, even though it’s draining. This can be very important to your financial well-being.

Disability Starter Kit

To make things a little bit easier, the SSA has created a Disability Starter Kit to help people prepare for their online application or disability interview. The kit contains a wealth of information about the documents you’ll need to submit, the disability programs that may be available to you, and details about their decision-making process.

Deciding If You’re Really Eligible

After you’ve completed your application, it goes to the Disability Determination Services (DDS) in your state for consideration.

These folks will contact your doctors or other caregivers to find out more details of your medical condition. It’s possible you may have to go for a special examination, either by your doctor or one picked by the DDS.

In the end, the DDS makes its recommendation to the SSA about whether to grant your application based on five questions:

- Are you working?

- Is your medical condition severe (according to SSA guidelines)?

- Does your condition match an SSA listing for disability?

- Can you do the type of work you did before?

- Can you do any other kind of work based on your age, education, and work experience?

This last point is crucial and is a reason many disability claims are denied.

Even if you’re unable to perform the kind of work you did before you suffered the disability, it’s possible that the government may think you may have the education, training, or physical skills to do something else – and they get to figure out what that might be. If they find anything you could do – even if there are no jobs available – your claim will probably be denied.

Yes, this sucks. And it’s incredibly common. Most claims get denied the first time. But it’s still worth it to go through the process because getting SSDI can make a big difference for your finances.

The SSA will notify you by letter of the outcome of your claim. If the claim’s been approved, the letter will tell you how much money you’ll get per month and when payments will start.

Appealing a Disability Benefits Denial

If your claim is denied and you disagree with the reason (outlined in the letter from the SSA), you have the right to appeal the decision.

Appealing a decision by the SSA for the denial of SSDI benefits is the same as any other SSA appeals process. There are further details on how the SSA appeals process works in my book, Social Security 101 2nd Edition

You can also find out more about appealing a disability benefits denial on the Social Security Administration’s website.

Family Disability Benefits

Because the government understands that your disability also affects your family members, it’s possible to obtain benefits for them as well.

These include:

- Your spouse, if she or he is sixty-two or older

- Your spouse, if she or he is caring for your child and the child is younger than sixteen or disabled

- Your unmarried disabled child younger than eighteen

- Your child eighteen or older if she or he has a disability that began before the child reached the age of twenty-two

These benefits are designed to provide support for the whole family.

Other Benefits and Disability

It’s possible for other benefits to be affected by your disability benefits. There’s a lot to this and I don’t want to confuse the situation, as this post is specifically about SSDI. However, you can find all of this information in my book, Social Security 101 2nd Edition.

The Ticket to Work Program

If your disability isn’t lifelong permanent or you want to try to keep working through your disability, SSA has a plan for that.

If you’re 18 through 64 years old and qualify for disability benefits, the SSA offers a program called Ticket to Work. Its objective is to train you, free of cost, in skills that can lead to employment. They also offer additional services and support to help you succeed.

The SSA explains it like this:

When you take part in the Ticket to Work program, you can get help finding a job, vocational rehabilitation, or other support. Employment networks and state vocational rehabilitation agencies provide these services.

These networks include private organizations and government agencies that have agreed to work with Social Security. They provide employment services and other support to beneficiaries with disabilities.

The key goal of the program is to move people toward self-sufficiency and to reduce their reliance on SSDI benefits. The agency offers work incentives that allow participants to continue to receive cash benefits while looking for the right job; if you can’t find suitable work, you can return to full benefits.

If you want to apply to participate in the program, you can call the Ticket to Work Help Line at 1-866-968- 7842 or visit the website at www.ssa.gov/work.

It Helps to Know What To Expect When It Comes to Disability Benefits and Social Security In General

Most people think of Social Security as that check you get when you reach retirement age.

That is part of it, but there’s a lot more to what Social Security is, what it does, and how it can help you, depending on your situation. When you know what is and is not possible, you can do a better job of planning for your future, whatever that future may hold.

That’s why I wrote Social Security 101 2nd Edition: From Medicare to Spousal Benefits, an Essential Primer on Government Retirement Aid.

This is a hands-on, engaging lesson that shows you everything you need to know about this federal program that’s been around since the Great Depression.

Most importantly, it has all the answers you need on how to make sure you are maximizing your benefits when and where you need to.

Click on the button below to get your copy now.