by Michele Cagan | Mar 15, 2017 | Do Your Own Taxes, Owning Your Own Business, Personal Finance

Click here to download the PDF for printing or full screen viewing. Want to find more ways to save on your taxes? My book Taxes 101 explains the ins and outs of the tax system and show you how you can make it work to your advantage. This comprehensive guide walks you...

by Michele Cagan | Mar 15, 2017 | Do Your Own Taxes, Owning Your Own Business, Personal Finance, Small Business

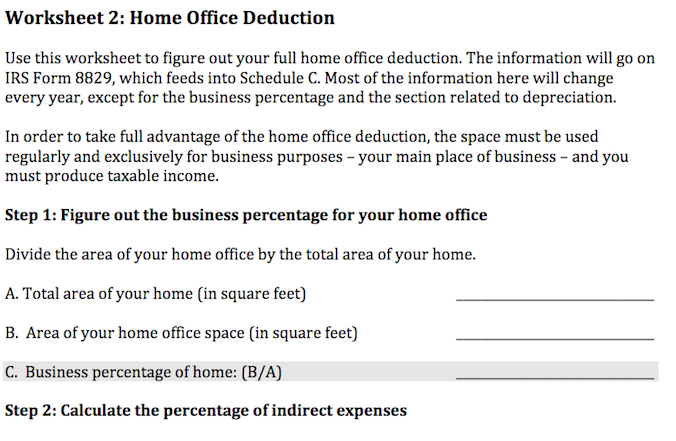

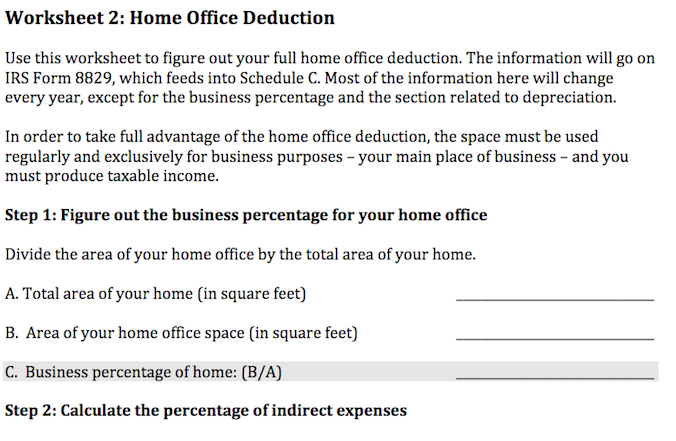

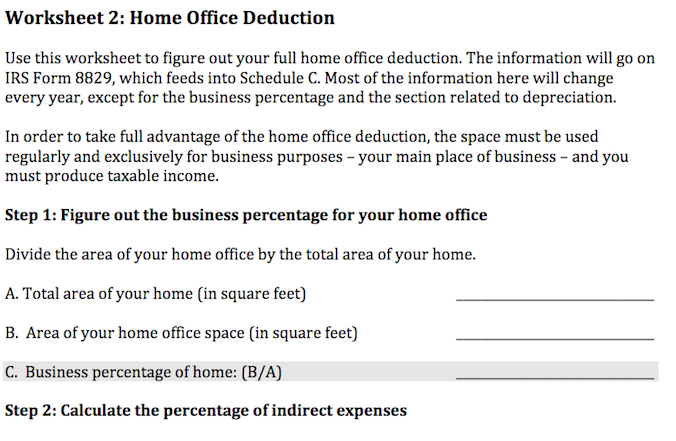

[pdf-embedder url=”http://michelecagancpa.com/wp-content/uploads/2017/03/Worksheet-1-2.pdf” title=”Business Income Worksheet”] Click here to download the PDF for printing or full screen viewing.

by Michele Cagan | Mar 7, 2017 | Do Your Own Taxes, Single Mom CPA

When you’re a single mom, it can be tough to find a distraction-free time to do your taxes. And with all of the forms, and papers, and numbers, it’s very easy to make a mistake on your tax return – it happens all the time. People forget to sign their returns, they...

by Michele Cagan | Mar 7, 2017 | Do Your Own Taxes, Personal Finance

With all of the forms, and papers, and numbers, it’s very easy to make a mistake on your income tax return – it happens all the time. Sometimes it’s a missed signature, sometimes it’s a miscalculated tax credit, and still other times it’s a number typed in wrong. In...

by Michele Cagan | Mar 3, 2017 | Do Your Own Taxes, Personal Finance

Don’t ignore it. Don’t throw it out. And, most importantly, if you get a letter from the IRS about your Earned Income Tax Credit (EITC), don’t panic. The first thing to do is read the letter – it has all the information you need to clear up whatever the issue is...

by Michele Cagan | Mar 1, 2017 | Do Your Own Taxes, Single Mom CPA

If you’re paying down a student loan for either you or your child, you can deduct up to $2,500 of the interest on your tax return – and you don’t even have to itemize to get that deduction. Yes, there are limits on the amount you can deduct, but many Americans can...