Note: This article was originally posted in 2017 but has been updated with more current information.

Depreciation is the most confusing part of the full home office deduction, but it can substantially minimize your current tax bill. That’s because when you reduce your business income, you’ll save on income taxes AND self-employment taxes, that extra 15.3% chunk of profits you have to pay the IRS.

Now you can only take a depreciation deduction if you own your home. And there might be a small tax issue on the other side when you eventually sell your home.

But the value of getting this extra tax break right now makes the calculation and the possible future tax bump worth it.

What Is Depreciation Anyway?

Depreciation is an accounting and tax calculation that puts a dollar value on the normal wear and tear of assets (things you own) that you use in your business. Instead of writing off the full value all at once, you break it down over time so your business gets a steady deduction over the full life of that asset.

Here, the business asset is your home – or at least the portion that you’re using for your home office. And each year you get to deduct a percentage of its value as a business expense – as long as you meet all the rules for the home office expense deduction.

Next step: figuring out just how much expense you get to deduct.

Depreciation Expense

The depreciation calculation can seem daunting – but you only have to do the hard part once, and after that it’s extremely simple. We’ll walk through that in detail, so you can make sure that the number your tax software comes up with looks right.

Figuring out Depreciation Expense

To make things easier, I created a free home office deduction worksheet that includes depreciation expense calculations. You can download that free worksheet here.

Before we start on the depreciation math, first comes the business percentage calculation. You can only take depreciation expense linked to the home office portion of your home, so you need to know exactly how big that space is.

To calculate the business percentage, divide the area of your home office (in square feet) by the total area of your home (in square feet). The result is your business percentage. Now we can get down to business and tackle the depreciation expense.

The first time you work this out, you’ll need to gather up some information:

- The total cost of your house when you bought it (find that on your closing statement)

- The value of the land when you bought your home (that will be on your property assessment, and possibly on your closing statement or property tax bill)

- The fair market value (FMV) of your home at the time you started using a home office (use the sales prices of similar houses sold at that time, then back out the land portion of the price)

- The full cost of any whole-home improvements you’ve made

- Any casualty losses (like flood damage) you’ve sustained related to your home that decreased its value

First, you need to calculate is the adjusted basis of your home. Here’s how to get that:

Adjusted basis = purchase price of home – land value + improvements – casualty losses

Next, compare the adjusted basis you just calculated to the FMV of your home (not including land).

Whichever number is less is the one you’ll use going forward, and you never have to figure it out again.

What counts as a home improvement?

Home improvements include only things that increase the value of your house, not just regular repairs and maintenance. Examples of improvements include replacing your roof, rewiring your electrical system, or updating the plumbing.

The Depreciation Calculation

Now that you know your basis for depreciation, you can figure out the depreciation expense. This part is pretty straightforward. According to the IRS, your home office counts as “nonresidential rental property” that gets depreciated over 39 years using the straight-line method. Basically, just divide the lesser of your adjusted basis or FMV by 39 and that’s the annual depreciation.

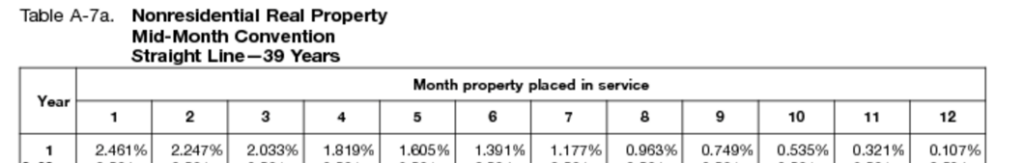

The only times the number will be different is the first year and last year you’re taking depreciation expense for your home office – but now we’re dealing with the first year. For that you have to use the IRS chart based on the month you started using the home office. Choose the percentage that’s listed next to the month you started using the home office this year. For example, if you started using it in June your percentage would be 1.391% for month 6.

These percentages come directly from the IRS website, and, again, they’re only applicable for the first year that you’re taking the home office deduction.

Now that you’ve figured out the current year depreciation, you have to multiply that number by the business percentage you calculated earlier.

—> Download the free calculation worksheet.

Let’s take a look at an example:

Hannah started using a home office in April 2024. She originally bought her townhouse for $400,000. According to her property assessment, the land was worth $50,000. She hasn’t made any improvements or suffered any casualty losses. Similar townhomes in her area were selling for about $450,000 in April. Her office is 120 square feet, and her whole townhome is 1,200 square feet.

Hannah’s adjusted basis of $350,000 ($400,000 – $50,000) is less than the FMV. Since she started using the home office in April, she multiplies her adjusted basis by 1.819% (according to the IRS chart for month 4). So the total deprecation for the whole townhouse for 2024 equals $350,000 x 1.819% = $6,366.50.

Next, Hannah has to multiply the total depreciation by her business percentage. Her business percentage works out to 10% (120/1200 = 10%). So her depreciation deduction for her home office in 2023 would be: $6.366.50 x 10% = $636.65.

Next year, and all the years she uses this home office, the total depreciation would equal $8,974.36 ($350,000/39 years). Her depreciation deduction every year would equal $897.44 ($8,974.36 x 10%).

What does that look like in real tax dollars? It depends on Hannah’s overall tax situation. But at the very least it will save her 15.3% of the deduction in self-employment taxes alone.

You can find more detailed information about depreciation and how to calculate it in IRS Publication 946.

What happens when I sell my house?

One of the biggest worries about taking the home office depreciation expense deduction involves the potential tax bill you’ll face when you sell the home. Yes, there may be one, but it will probably be a lot less than the total deductions you’ve taken through the years – an overall financial win for you. Plus, using this deduction now will reduce both your income taxes and self-employment taxes for a bigger win right now.

Here’s the deal: Any deprecation you’ve taken on your home turns into a taxable gain when you sell your house. That’s because of an IRS concept called depreciation recapture.

If you take the full home office deduction (instead of using the simplified version), this tax issue will crop up even if you don’t take the depreciation expense. It’s based on the amount of depreciation expense you could have taken whether or not you did. You don’t win by skipping it, so it pays to take the tax benefit now.

An example of how depreciation recapture works:

Let’s say Hannah (remember Hannah from the depreciation calculation?) sells her townhome in 5 years for $500,000, for a gain of $100,000 ($500,000 – $400,000). Over the years, she took $4,226.41 in depreciation expense ($897.44 x 4 years + $636.65). On her tax return in the year of the home sale, Hannah will have to report that $4,226.41 recaptured depreciation as a capital gain and pay a maximum 25% tax on it (the current maximum tax rate for recaptured depreciation).

Hannah’s tax on the recaptured depreciation comes to $1,056.60.

And what about capital gains on the sale of the house? As long as your home office is actually inside your house – as opposed to in a detached garage or separate guesthouse, for example – it falls under the standard home sale exclusion, meaning not extra taxable.

Bottom Line:

The home office depreciation expense deduction may be one of the more complicated issues on your tax return, but it’s worth doing if you’re going take the full home office deduction. Most of the math will be built into your tax prep software (though it might be tough to find a free version that will handle this) or handled by your tax pro. So the hardest part for you will be getting all of the information together.

There are a lot more ways you can save money on your taxes. And you should! You work hard for what you earn.

I explain how the tax system works and show you how you can make it work to your advantage in my book Taxes 101. This comprehensive guide walks you through everything you need to know about our tax system, so you can make the best decisions for your own financial wellness.

Click on the button below to learn more and get your copy of Taxes 101 now.